9 Tricks How To Find The Risk Free Rate Free

8 Awesome How To Find The Risk Free Rate - E (ri) = rf + βi*erp. Determine the length of time that is under evaluation.

How to find the risk free rate

7 Latest How To Find The Risk Free Rate. In practice, it does not exist because every investment is having a certain amount of risk. Proxy for risk free rate: Here we will do the same example of the risk premium formula in excel. How to find the risk free rate

Related

The below numbers are pulled from dec. If the length of time is one year or less, then the most comparable government securities are treasury bills. Market risk premium market risk premium the market risk premium is the supplementary return on the portfolio because of the additional risk involved in the portfolio; How to find the risk free rate

It also helps to determine the weight average cost of capital (wacc) of the firm. It is very easy and simple. Compute or locate the beta of each company. How to find the risk free rate

For example, if it is 0.204, then the risk free rate is 0.2 percent. Is the starting point of any return. Risk free rate incidentally, the federal reserve has extensive time series of interest rates.almost any short term rate on the list would be appropriate and would not change the analysis. How to find the risk free rate

Go to the treasury direct website and look for the treasury bill quote that is most current. In the first example, risk free rate is 8% and the expected returns are 15%. E (r m) = expected market return. How to find the risk free rate

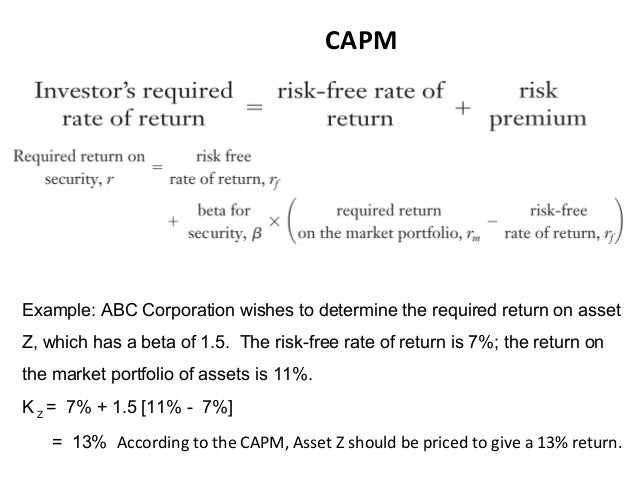

I have computed daily logarithmic returns for every stock and for the market, i now need to calculate the risk free interest rate in order to be able to compute the excess return for every stock and the market. I've seen several valuations by two of the biggest investment banks and they both use a Use the capm formula to calculate the cost of equity. How to find the risk free rate

Based on the assumptions, you will be paid 7.08% for the risk of the mutual fund. Wacc is referred to as the minimum rate of return that is required to create a suitable value for a particular firm. I'm working on an assignment in which i need to calculate excess returns for six stocks plus the s&p 500. How to find the risk free rate

You need to provide the two inputs of an expected rate of returns and risk free rate. A) 10 year risk free eur rate = 10 year bunds = 1.89%. Generally, this rate of return will be regarded as the basic return, and then various risks that may arise are considered. How to find the risk free rate

It is the hypothetical rate of return; So in the case of the risk free rate for an italian company i would compare: You can easily calculate the risk premium using formula in the template provided. How to find the risk free rate

Higher of 10 year risk free govie yield in currency or inflation ). How to find the risk free rate