8 Classified How To Pay Irs Work

5 Strategy How To Pay Irs - There's also a penalty for failure to file a tax return, so you should file timely even if you can't pay your balance in full. Direct pay with bank account.

/drip-dividend-renivestment-plan-5902b8ed5f9b5810dc4b1767.jpg) How to Pay the IRS if You Owe Taxes . How to pay irs taxes online.

How to Pay the IRS if You Owe Taxes . How to pay irs taxes online.

How to pay irs

8 Successful How To Pay Irs. Electronic funds withdrawal (efw) is another way to pay taxes, but in some cases, you may have to pay a small fee to your financial institution. Us expats sometimes owe the irs money. The irs offers a series of directions on its website to help us citizens figure out their taxes, report those taxes, and send in payments (or ask for. How to pay irs

Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your checking or savings account at no cost to you. No part of the card service fee goes to irs. Irs direct pay the irs also offers direct pay, a similar web service. How to pay irs

Instead, go in person to an irs office to pay with cash. It's always in your best interest to. Employees don’t pay that tax. How to pay irs

With direct pay, taxpayers can schedule payments up to 30 days in advance. Pay your taxes, view your account or apply for a payment plan with the irs. You’ll need to complete irs form 940 to report and pay those taxes each year. How to pay irs

How to pay the irs taxes due from overseas. Are you an american expat or us resident alien who owes money to the. Bring exact change to make paying How to pay irs

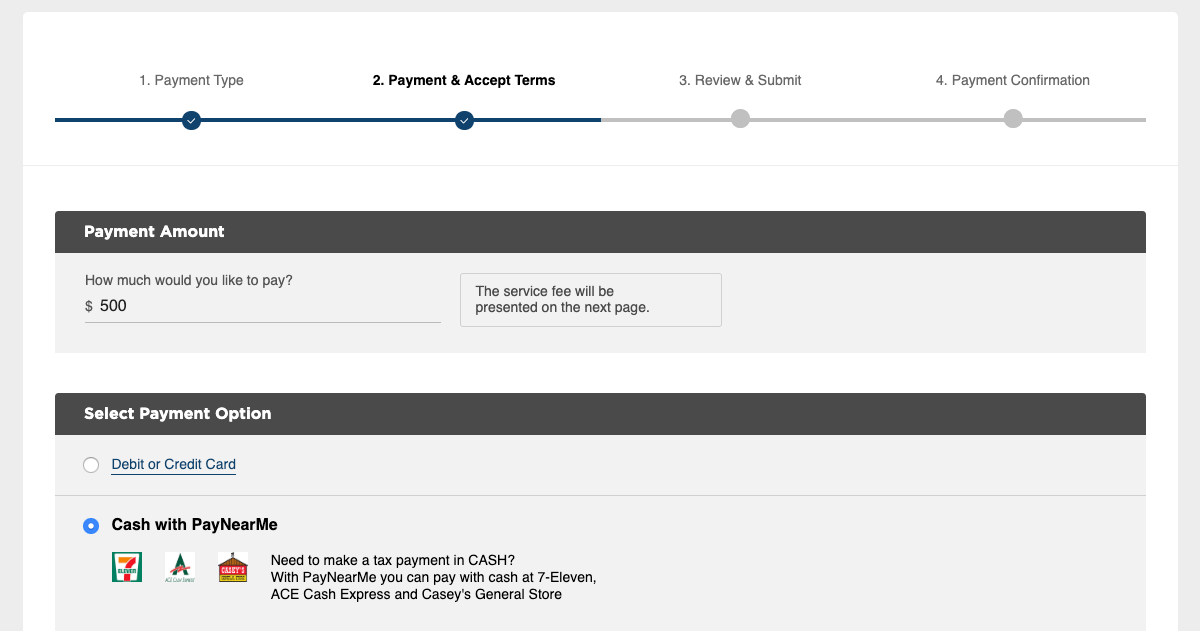

The most popular way to pay back the irs is through a monthly installment agreement. We accept full and partial payments, including payments toward a payment plan (including installment agreement). Provide your tax information this includes How to pay irs

How to make a payment to the irs online, by mail, and in person.ways to pay the irs, your income taxes, 1040 in person, mail, a. Taxpayers receive instant confirmation once they’ve made a payment. You can pay online, by phone or by mobile device no matter how you file. How to pay irs

According to the irs, every individual who operates the business or trade using heavy vehicles on public highways needs to pay hvut. If you owe more than $50,000, you must negotiate a payment plan with the irs. Irs direct pay only accepts individual tax payments. How to pay irs

You can easily keep track of your payment by signing up for email notifications about your tax payment, each time you use irs direct pay. Pay through the electronic federal tax payment system or by using a credit or debit card, money order, or check.your deferred. If you're not able to pay the tax you owe by your original filing due date, the balance is subject to interest and a monthly late payment penalty. How to pay irs

There are five steps to this process: Key takeaways the irs has announced that it will begin accepting and processing 2021 tax returns on jan. The rate is 6% on employee wages above $1,500 in any calendar quarter. How to pay irs

Extension make a full or partial payment on your taxes in order to receive an extension without filing form 4868, application for automatic extension of time to file for u.s. How to pay irs taxes with electronic funds withdrawal? Former tax professional and bookkeeping consultant.this channel is the remnant of my former tax and accounting business that ran from 201. How to pay irs

Make your tax payments by credit or debit card. There are several payment options to pay your us taxes from abroad. They can change or cancel a payment two business days before the scheduled payment date. How to pay irs

This site doesn't retain your bank account or personal information, so you'll have to reenter all this data every time you want to make a payment. In general, the irs does not make it difficult for you to pay money you owe for taxes. Truckers pay hvut through form 2290 to the irs within the due date of the tax year. How to pay irs

Taxpayers can pay tax bills directly from a checking or savings account free with irs direct pay. Learn your options and fees that may apply. If you didn't pay your taxes when you filed your return, you can pay online, through the mail, or even with cash in person. How to pay irs

Pay the penalty with cash at the nearest irs office. If you’d prefer to pay the penalty off in cash, do not send the cash through the mail. Employers pay federal and state unemployment taxes to fund unemployment benefits for employees who lose their jobs. How to pay irs

You can pay the irs in several ways when the time comes: The irs asks that you follow these guidelines in making your payment: How to pay irs

Best Option to Pay Taxes 7 Ways You Can Send Payments to . The irs asks that you follow these guidelines in making your payment:

Best Option to Pay Taxes 7 Ways You Can Send Payments to . The irs asks that you follow these guidelines in making your payment:

How to Pay IRS Advance Taxes Finance Zacks . You can pay the irs in several ways when the time comes:

How to Pay IRS Advance Taxes Finance Zacks . You can pay the irs in several ways when the time comes:

How to Pay Federal Estimated Taxes Online to the IRS . Employers pay federal and state unemployment taxes to fund unemployment benefits for employees who lose their jobs.

How to Pay Federal Estimated Taxes Online to the IRS . Employers pay federal and state unemployment taxes to fund unemployment benefits for employees who lose their jobs.

Quarterly Taxes 5 Quick Steps to Pay Estimated Tax . If you’d prefer to pay the penalty off in cash, do not send the cash through the mail.

Phone Call to IRS how to pay bills with just my signature . Pay the penalty with cash at the nearest irs office.

Phone Call to IRS how to pay bills with just my signature . Pay the penalty with cash at the nearest irs office.

How to Pay the IRS online YouTube . If you didn't pay your taxes when you filed your return, you can pay online, through the mail, or even with cash in person.

How to Pay the IRS online YouTube . If you didn't pay your taxes when you filed your return, you can pay online, through the mail, or even with cash in person.

How to Pay Zero Taxes How to Pay Zero Taxes Your Guide . Learn your options and fees that may apply.

How to Pay Zero Taxes How to Pay Zero Taxes Your Guide . Learn your options and fees that may apply.

IRS Payment Plans How to Pay Off Debt Over Time . Taxpayers can pay tax bills directly from a checking or savings account free with irs direct pay.

IRS Payment Plans How to Pay Off Debt Over Time . Taxpayers can pay tax bills directly from a checking or savings account free with irs direct pay.

Irs Payment Instructions www.irs.gov/payments/viewyour . Truckers pay hvut through form 2290 to the irs within the due date of the tax year.

Irs Payment Instructions www.irs.gov/payments/viewyour . Truckers pay hvut through form 2290 to the irs within the due date of the tax year.