13 Jackpot How To File A 1099 Form Work

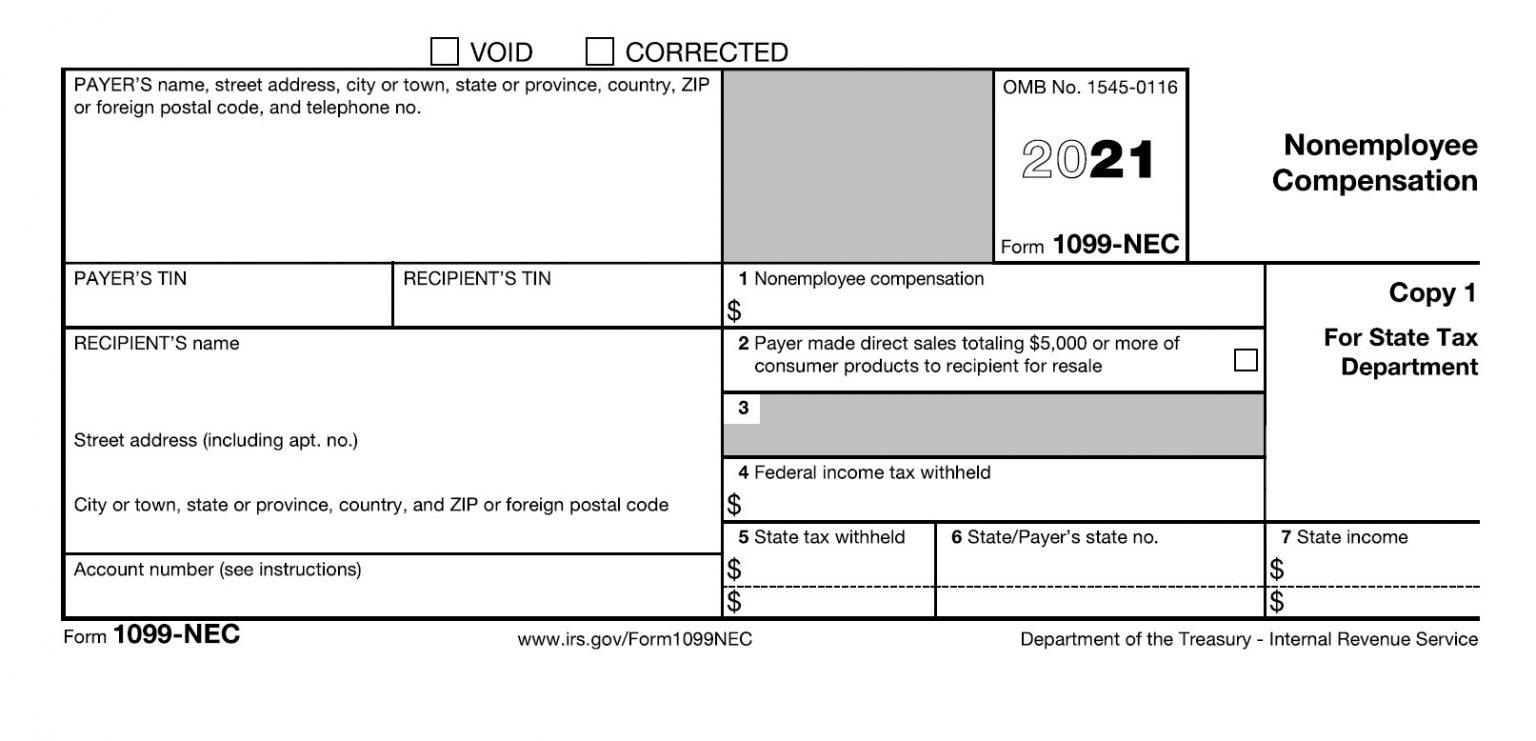

5 Unassuming How To File A 1099 Form - 1099 form is the tax form that the business individuals will use to report compensations paid to independent contractors. Send 1099 copy a to.

EFile Form 1099DIV Online How to File 1099 DIV for 2019 . Your total gross revenues are $64,000 (50,000 + 10,000 + 4,000).

EFile Form 1099DIV Online How to File 1099 DIV for 2019 . Your total gross revenues are $64,000 (50,000 + 10,000 + 4,000).

How to file a 1099 form

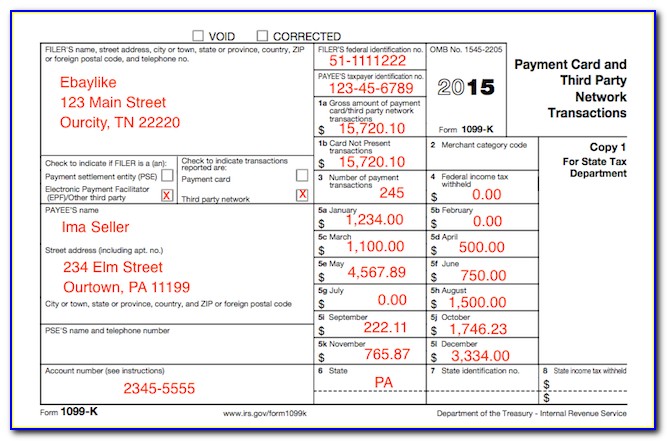

10 Remarkable How To File A 1099 Form. Other forms i.e., 1099 k, 1099 r, 1099 int, 1099 div, 1099 a deadlines for the tax year 2021 are here. You will get a 1099 form in the mail if you received certain types of income or payments (other than wages, salaries, or tips ) during the year. 1099's can include stocks, interests, pensions, and profit sharing. How to file a 1099 form

Read below to see what kinds of income you may receive a 1099 for and how to file taxes with this tax form. This includes any services performed by anyone who is not your direct employer. Rent, or rewards of $600 or more in a calendar year as. How to file a 1099 form

You must file a 1099 form for every individual or entity you paid more than $600 during the year. Follow these steps to prepare and file a form 1099: You only need to file 1099s. How to file a 1099 form

In order to be in the best position to file your form 1099, you should obtain a form 1099 from the irs. This includes any services performed by anyone who is not your direct employer. If your miscellaneous payments exceed $600 such as payments from rentals or crop insurance, then you need to report them and file your income taxes through form 1099. How to file a 1099 form

The irs has reduced the 1099 paper file threshold to just 100 forms (combining all form types). It will help you understand each field of the form with some examples and particulars. Once you’ve signed in to taxbandits, select “start new” in the upper right corner: How to file a 1099 form

Jan 9 2021 by merlin no comments. After obtaining the form you must file copy a with the irs, copy 1 must be filed with your state tax department, copy b and copy 2 must go to the recipient of the income and copy c is kept for your own recordkeeping. When you earn income through the below payments, the you receive a 1099 form: How to file a 1099 form

Reporting your 1099 form is simple on the efile tax app; Use it to report to your contractors, and to the irs, how much they were paid over the course of the tax year. To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10.form 1099 int online | 1099 int form online, form 1099 that’s because each bank, financial institution or other entity that pays you at least $10 of interest during the year must: How to file a 1099 form

When to file a 1099 form the florist from the example above is now required to file a 1099misc with the irs. Form 1099 is a type of informational return; Read more to learn how to make filing your 1099's faster. How to file a 1099 form

1099 Printing Software & Form 1099 Filing Software . Read more to learn how to make filing your 1099's faster.

1099MISC Software to Create, Print & EFile Form 1099MISC . Form 1099 is a type of informational return;

How to File Your Uber 1099 Tax Help for Uber Drivers . When to file a 1099 form the florist from the example above is now required to file a 1099misc with the irs.

How to File Your Uber 1099 Tax Help for Uber Drivers . When to file a 1099 form the florist from the example above is now required to file a 1099misc with the irs.

Understanding Your Tax Forms 2016 1099DIV, Dividends And . To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10.form 1099 int online | 1099 int form online, form 1099 that’s because each bank, financial institution or other entity that pays you at least $10 of interest during the year must:

Understanding Your Tax Forms 2016 1099DIV, Dividends And . To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10.form 1099 int online | 1099 int form online, form 1099 that’s because each bank, financial institution or other entity that pays you at least $10 of interest during the year must:

How To File A 1099 Form Online Free Form Resume . Use it to report to your contractors, and to the irs, how much they were paid over the course of the tax year.

How To File A 1099 Form Online Free Form Resume . Use it to report to your contractors, and to the irs, how much they were paid over the course of the tax year.

Understanding the 1099 5 Straightforward Tips to File . Reporting your 1099 form is simple on the efile tax app;

Understanding the 1099 5 Straightforward Tips to File . Reporting your 1099 form is simple on the efile tax app;

Efile Form 1099MISC Online How to File 1099 MISC for 2019 . When you earn income through the below payments, the you receive a 1099 form:

Efile Form 1099MISC Online How to File 1099 MISC for 2019 . When you earn income through the below payments, the you receive a 1099 form:

Surviving the Tax Season How to Read Form 1099B . After obtaining the form you must file copy a with the irs, copy 1 must be filed with your state tax department, copy b and copy 2 must go to the recipient of the income and copy c is kept for your own recordkeeping.

How to Fill Out and Print 1099 MISC Forms . Jan 9 2021 by merlin no comments.