7 Sly How To Do Balance Transfers On Credit Cards Full

5 Intelligent How To Do Balance Transfers On Credit Cards - A balance transfer credit card is a special type of credit card designed to receive an outstanding balance transferred from one or more other credit cards. Balance transfers to existing credit cards it’s sometimes possible to initiate a balance transfer on a card you already own.

How To Do A Balance Transfer With Capital One . Only the application affects your credit score, not the approved or denied outcome, but opening several cards in a short period will bring your credit down.

How to do balance transfers on credit cards

8 Fail Proof How To Do Balance Transfers On Credit Cards. However, your application is more likely to be accepted if you have an excellent fico credit score (between 740 to 850), so it’s helpful to. But it’s possible to get a credit limit as high as $1,000. Balance transfer cards can be a great way to pay off credit card balances, but it really does pay to understand how they work. How to do balance transfers on credit cards

So the balance plus the fee must be less than or equal to your credit limit on the new card. Our guide explains how balance transfer cards work and what to watch out for. Are you wondering, how do balance transfers on credit cards work, and what is a balance How to do balance transfers on credit cards

Balance transfers cost you a percentage of the total debt transferred, usually 3% to 5%. $0 balance transfer fee at the transfer apr and $0 annual fee. Though some card issuers don't allow balance transfers from personal loans, many do. How to do balance transfers on credit cards

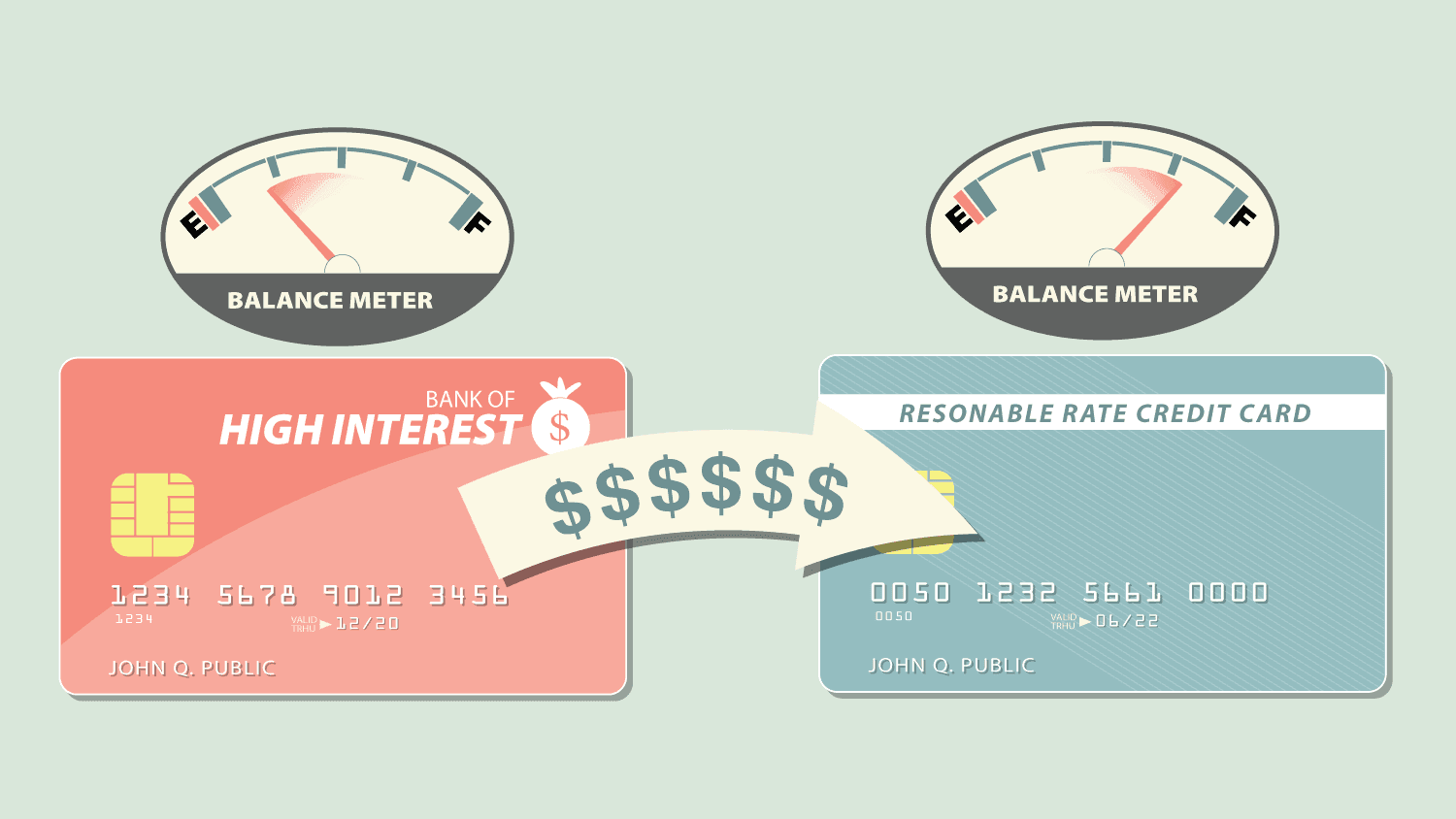

Balance transfer cards help you manage your money by moving your debt to a lower interest rate. Banks often use these offers to attract new customers. Fee harvesting cards charge fees for. How to do balance transfers on credit cards

So check our guides to balance transfers to learn more. Since recent credit applications—along with new cards you've actually opened—make up 10% of your credit score, applying for a balance transfer credit card could cause your credit score to drop. One of the common ways to manage multiple credit cards and pay off debt quickly is by doing a credit card balance transfer. How to do balance transfers on credit cards

It could save you money and help you simplify your payments — but watch out for fees and other potential drawbacks. The capital one platinum secured credit card requires a minimum deposit of $49, $99 or $200 to open. If you still have a good credit. How to do balance transfers on credit cards

26.99% variable apr applies to all balance transfers. Effect on your credit score: You take fees into account: How to do balance transfers on credit cards

The discover it balance transfer card is for consumers with a fico credit score in the good to excellent range. This is why you can’t, for example, transfer a balance from one citi credit card to another citi card — the bank isn’t getting a new customer or taking on any new (potentially very profitable) debt. This can work to your advantage if the issuer is running a promotion and you’ve already established positive credit history. How to do balance transfers on credit cards

For example, the citi simplicity® card offers a 21 months intro apr period, but only on transfers you make within 4 months. If credit cards with 0% introductory balance transfer offers have caught your eye, you may be wondering if you can use a balance transfer to pay off a personal loan. Some balance transfer cards offer a 0% intro apr for balance transfers for a limited amount of time. How to do balance transfers on credit cards

Interest rates for balance transfers vary, but it’s possible to find credit cards—both personal and business—offering an introductory 0% apr on. Most balance transfer credit cards require good to excellent credit—670 or higher. A balance transfer is a process that lets you move debt, or a “balance,” from a credit card or loan to another credit card. How to do balance transfers on credit cards

When you apply for a new credit card, your credit score may dip as a result of a hard inquiry being added to your credit report. A few cards do not charge a transfer fee. If you're not quite there yet, look into ways to improve your score. How to do balance transfers on credit cards

Louis denicola is a personal finance writer and has written for american express and discover. Credit cards targeted at consumers with poor credit scores that carry numerous fees, making the cost of credit extraordinarily expensive. That fee gets added to your balance on the new card. How to do balance transfers on credit cards

This means your credit score will need to be between 670 and 850 to qualify for this card. You'll save money because many balance transfer credit cards come with a 0% introductory annual percentage rate for a period of time, usually from 12 to 21 months. With many balance transfer credit cards, you must transfer your balances within a certain period to qualify for the intro apr. How to do balance transfers on credit cards

However, for some cards it's a bit more complicated, as certain providers extend this to prevent transfers between cards from the same banking group : How to do balance transfers on credit cards

Credit Card Balance Transfers What you need to know YouTube . However, for some cards it's a bit more complicated, as certain providers extend this to prevent transfers between cards from the same banking group :

Credit Card Balance Transfers What you need to know YouTube . However, for some cards it's a bit more complicated, as certain providers extend this to prevent transfers between cards from the same banking group :

How to Come Out Ahead on Credit Card Balance Transfers . With many balance transfer credit cards, you must transfer your balances within a certain period to qualify for the intro apr.

How to Come Out Ahead on Credit Card Balance Transfers . With many balance transfer credit cards, you must transfer your balances within a certain period to qualify for the intro apr.

Understanding Balance Transfers On Credit Cards . You'll save money because many balance transfer credit cards come with a 0% introductory annual percentage rate for a period of time, usually from 12 to 21 months.

Balance transfers explained . This means your credit score will need to be between 670 and 850 to qualify for this card.

Balance transfers explained . This means your credit score will need to be between 670 and 850 to qualify for this card.

How Do Credit Card Balance Transfers Work . That fee gets added to your balance on the new card.

How Do Credit Card Balance Transfers Work . That fee gets added to your balance on the new card.

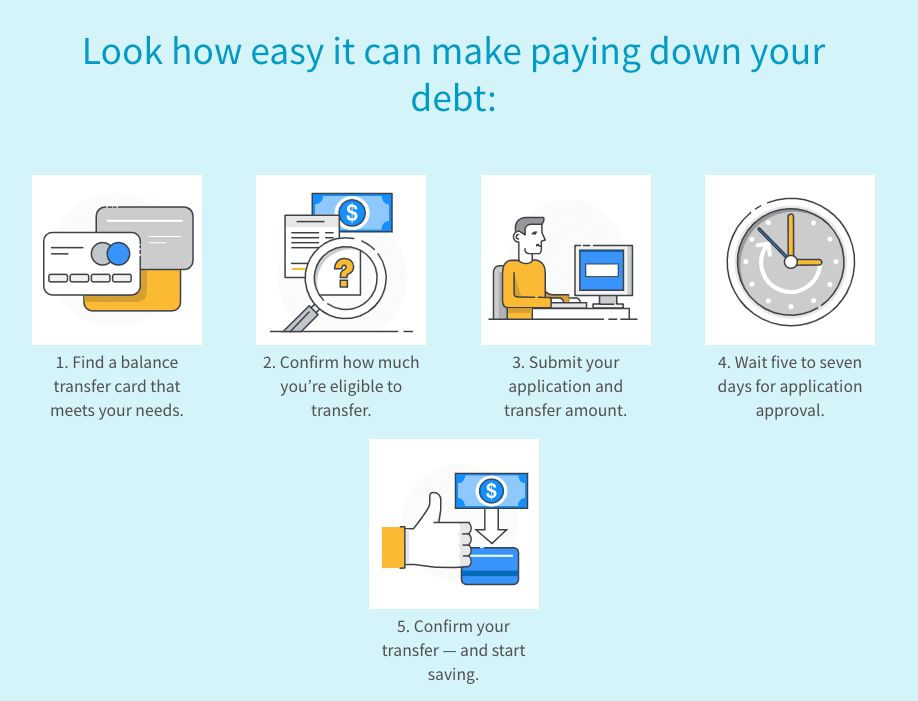

Infographic How To Do A Credit Card Balance Transfer . Credit cards targeted at consumers with poor credit scores that carry numerous fees, making the cost of credit extraordinarily expensive.

Are Credit Card Balance Transfers A Smart Idea? Good . Louis denicola is a personal finance writer and has written for american express and discover.

Are Credit Card Balance Transfers A Smart Idea? Good . Louis denicola is a personal finance writer and has written for american express and discover.

How Credit Card Balance Transfers Work GOBankingRates . If you're not quite there yet, look into ways to improve your score.

How Credit Card Balance Transfers Work GOBankingRates . If you're not quite there yet, look into ways to improve your score.

How Does a Balance Transfer Affect Your Credit . A few cards do not charge a transfer fee.

How Does a Balance Transfer Affect Your Credit . A few cards do not charge a transfer fee.