5 Compulsive How To Figure Interest Work

10 Jackpot How To Figure Interest - Simple interest formula the formula for simple interest is a = p(1 + rt), where p is the initial principal, r is the interest rate and t is the time in years. ($99,900.45 principal x 0.005 = $499.50).

How to Calculate Total Interest Paid on a Car Loan 15 Steps . You're paying toward both principal and interest over a set period.

How to Calculate Total Interest Paid on a Car Loan 15 Steps . You're paying toward both principal and interest over a set period.

How to figure interest

10 Fail Proof How To Figure Interest. F v = p v ( e i ∗ t) {\displaystyle fv=pv (e^ {i*t})} , where fv is the future value of the investment, pv is the present value, e is. You don’t pay down any principal in the early years—only interest. You will subtract the interest due for. How to figure interest

How to figure out and calculate annual interest rates. You can use nerdwallet’s savings calculator to figure how much interest you could earn with different rates and time periods. $200,000 x 0.04 = $8,000. How to figure interest

Your january payment is the same as your december 1 payment, because it is amortized. If the $10,000 deposit is. Interest rate (apr) when using a figure for this input, it is important to make the distinction between interest rate and annual percentage rate (apr). How to figure interest

R = your monthly interest rate. Lenders provide you an annual rate so you’ll need to divide that figure by 12 (the number of months in a year) to get the monthly rate. To figure your remaining balance after your january 1 payment, you will compute it using the new unpaid balance: How to figure interest

If the interest rate increases to 7 percent, the cost of interest rises to $3,761.44. I = p r t. Here’s an example of how to calculate apy. How to figure interest

4 it doesn’t account for any interest you earn over time and will always be calculated based on your principal deposit, or the original amount of money deposited into your account, as long as you don’t add to or subtract from the principal balance. Simple interest simple interest is money earned on the original amount of your deposit. If your interest rate is 5. How to figure interest

The simple interest formula for calculating total interest paid on the loan is: This is known as the periodic interest rate or daily interest rate. {\displaystyle i=prt.} however, banks typically charge compound interest on loans. How to figure interest

For example, if you have an apr of 6.5%, you will create this equation: Compute the interest for month two: Especially when very large loans are involved, such as mortgages, the difference. How to figure interest

Principal x interest rate x number of years = total interest due on loan. Watch my latest videos here: The total is approximately 0.018% or 0.00018, which is your daily interest rate. How to figure interest

Interest may be computed as simple interest, which is calculated by multiplying the amount of money borrowed by the interest rate and the length of the loan. It's one of the four relevant loan terms that this interest rate calculator will figure for you. To calculate continuous interest, use the formula. How to figure interest

If you're taking a loan, it's also wise to figure out all To calculate credit card interest, divide your interest rate, or apr, by 365 for each day of the year. R is the interest rate as a decimal (i.e., 0.11% or 0.0011). How to figure interest

Say you deposit $100,000 into an account with a.05% annual interest rate that compounds monthly. Because you’re making monthly, rather than annual, payments throughout the year, that interest rate gets divided by 12 and multiplied by. If an investment accrues monthly, for example, n is 12. How to figure interest

The mathematical equation for calculating simple interest is. Subtract the interest costs from the monthly payment. Subtract the initial principal if you want just the interest figure. How to figure interest

Each time you calculate amortization, you subtract the principal amount repaid in the prior month. Calculate the principal amount for month two: $99,900.45 x 6% interest = $5,994.03 ÷ by 12 months = $499.50 interest due for december. How to figure interest

You’ll also need to find out whether your loan features a fixed interest rate. Interest rates are one of the most important factors to consider when you apply for a loan. Figure the monthly interest by multiplying the monthly rate by the loan balance at the start of the month ($100,000 multiplied by 0.5% equals $500 for the first month). How to figure interest

N is the number of periods the investment compounds in a year. How to figure interest

Formulas and Examples to Calculate Interest on Savings . N is the number of periods the investment compounds in a year.

Formulas and Examples to Calculate Interest on Savings . N is the number of periods the investment compounds in a year.

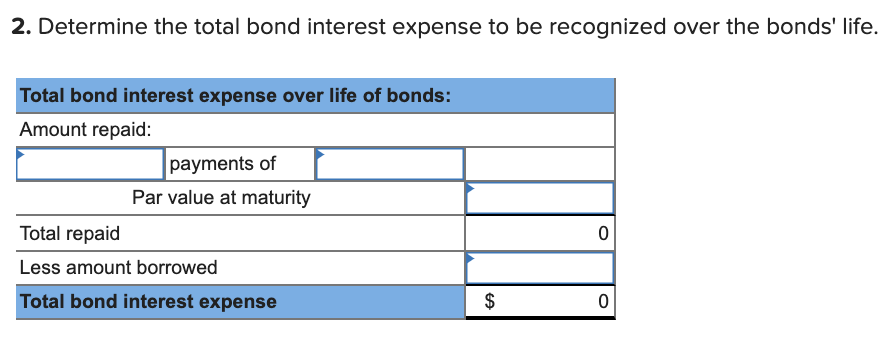

How to Figure Out Total Bond Interest Expense ⋆ Accounting . Figure the monthly interest by multiplying the monthly rate by the loan balance at the start of the month ($100,000 multiplied by 0.5% equals $500 for the first month).

How to Figure Out Total Bond Interest Expense ⋆ Accounting . Figure the monthly interest by multiplying the monthly rate by the loan balance at the start of the month ($100,000 multiplied by 0.5% equals $500 for the first month).

How to Calculate an Interest Payment Using Microsoft Excel . Interest rates are one of the most important factors to consider when you apply for a loan.

Mortgage Payment Calculator Calculate Your Ideal Payment . You’ll also need to find out whether your loan features a fixed interest rate.

Mortgage Payment Calculator Calculate Your Ideal Payment . You’ll also need to find out whether your loan features a fixed interest rate.

How to Calculate Compound Interest 15 Steps wikiHow . $99,900.45 x 6% interest = $5,994.03 ÷ by 12 months = $499.50 interest due for december.

/Interest-formula_7-589b92f45f9b58819cafefaf.jpg) Calculate Simple Interest Principal, Rate, or Time . Calculate the principal amount for month two:

Calculate Simple Interest Principal, Rate, or Time . Calculate the principal amount for month two:

Simple Interest Part One Passy's World of Mathematics . Each time you calculate amortization, you subtract the principal amount repaid in the prior month.

3 Ways to Calculate Mortgage Interest wikiHow . Subtract the initial principal if you want just the interest figure.

3 Ways to Calculate Mortgage Interest wikiHow . Subtract the initial principal if you want just the interest figure.

Capital Interest Repayment Tables . Subtract the interest costs from the monthly payment.

Capital Interest Repayment Tables . Subtract the interest costs from the monthly payment.