8 Classified How To Calculate The Cost Of Equity Latest

5 Validate How To Calculate The Cost Of Equity - Cost of equity is the return that a company requires for an investment or project, or the return that an individual requires for an equity investment. Today, the annual dividend is $1.68 per share and the stock currently trades around $55.

How to calculate the cost of equity

13 Jackpot How To Calculate The Cost Of Equity. For example, the expected dividend to be paid out next year by abc corporation. Β i = beta of asset i. Wacc, or weighted average cost of capital, measures a company’s cost to borrow money. How to calculate the cost of equity

Related

Cost of equity or require rate of return is a more formal name for discount rate. Else, they may shift to other opportunities with higher returns. Online cost of equity calculator to calculate equity given by the company and help user to share the result. How to calculate the cost of equity

Cost of equity is an important input in different stock valuation models such as dividend. In my ddm calculator, i have implemented two methods for calculating the discount rate. The wacc formula uses the company’s debt and equity in its calculation. How to calculate the cost of equity

Cost of equity is always cheaper than cost of debt since debt investment is secured through assets and debtholders have a higher preference than equity holders if the company is. How we calculate the discount rate or cost of equity? The number of shares outstanding is 100,000 and the How to calculate the cost of equity

That’s pretty far off from our dividend capitalization model calculation. It is also called cost of common stock or required return on equity. Why capm is better we have already mentioned two assumptions of the dividend growth model that restrict it in becoming the preferred choice of financial analysts and accountants. How to calculate the cost of equity

The dividend discount model and the capital asset pricing model (capm). E (ri) = rf + βi*erp. Cost of equity (constant dividend growth) calculator is easy to calculate the accurate cost of equity. How to calculate the cost of equity

As long as the market tandem holds as it does, as per company m’s beta, the stock of company m should increase, decrease, or stay on the upmove. One way to derive the cost of equity is the dividend capitalization model, which bases the cost of equity primarily on the dividends issued by a company. Read more is what shareholders expect to invest their equity. How to calculate the cost of equity

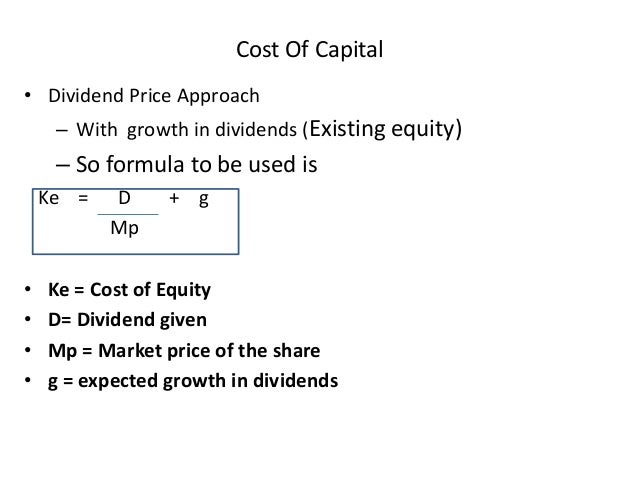

R f = risk free rate of return. (dividends per share for next year ÷ current market value of the stock) + dividend growth rate. About in finance, the cost of equity is a rate of return a company pays outs to equity investors or shareholders. How to calculate the cost of equity

Estimating the cost of equity capital, however, is difficult as there is no fixed dividend or principal payment burden associated with it. It is a parameter for the investors to decide whether an investment is rewarding or not; This calculation of cost of equity is then used to calculate the weighted average cost of capital which is then used as a discounting factor in financial modeling for various purposes. How to calculate the cost of equity

Learn to calculate starbucks cost of equity (ke) in excel. How do you calculate cost of equity using capm? The beta is a determinant of the cost of equity, but it is highly unstable and hence calculations using beta often keep fluctuating over time. How to calculate the cost of equity

The cost of equity, or rate of return of mcdonald’s stock (using the capm) is 0.078 or 7.8%. The company with the highest beta sees the highest cost of equity and vice versa. Calculate the cost of common stock equity. How to calculate the cost of equity

Dividend discount model (gordon model) this method can be employed when you need to determine the value of the stock's dividend. There are several formulas you can use to calculate various parts of the equity formula, including the wacc and capm formulas. To calculate its cost of equity under the dividend growth model, xyz co., needs some information. How to calculate the cost of equity

The cost of debt capital (as well as preference capital) can be calculated fairly easily. By using the above formula, we can calculate the cost of common stock equity as follows: It expects its dividends next year to be $0.5 per share. How to calculate the cost of equity

Now that we have all the information we need, let’s calculate the cost of equity of mcdonald’s stock using the capm. Use the capm formula to calculate the cost of equity. Current year dividend constant growth rate cost of. How to calculate the cost of equity

Cost of equity (k e) is the minimum rate of return which a company must earn to convince investors to invest in the company's common stock at its current market price. E (r i) = expected return on asset i. Similarly, it expects dividends to increase at a rate of 6% every year after. How to calculate the cost of equity

Cost of equity (ke) cost of equity (ke) cost of equity is the percentage of returns payable by the company to its equity shareholders on their holdings. Let us take an example of starbucks and calculate the cost of equity using the capm model. Here are the two models and how to calculate the cost of equity: How to calculate the cost of equity

There are two methods for calculating the cost of equity: There are 3 basic inputs required for calculating and they are as follows: D 1 = $4 p 0 = $50 now let’s calculate the dividend growth rate first. How to calculate the cost of equity